- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

But have faith that there are plenty of ways to reduce your debtfaster than you think. To save the most money and eliminate your debt in the shortest amount of time pay off your cards in order of annual percentage rate.

How To Get Out Of Credit Card Debt Real Simple

Pay minimum payments on everything but the little one.

Ways to lower credit card debt. Use the extra money to pay off what you owe. When it comes to paying off credit card debt theres no better way than the debt snowball method. Establishing a payment plan to pay off existing balances.

You pay off your credit card balances from the highest APR to the lowest APR. Then put the money aside in savings instead of putting it on your credit card. List your credit card debt from smallest to largest dont worry about interest rates.

Often this option can help you reduce your overall debt and help you pay it off in a shorter period of time. Balance Transfer Credit Card. The first debt-repayment strategy is to consolidate credit card debt with a personal loan.

Pay more than the minimum repayment. If you decide to tackle your debt on your own one option is called the debt avalanche. Consolidate credit card debt with a personal loan.

It is very important however that when it comes to consolidation you understand the fees and rules. You can save a bundle of money in interest if you are able to consolidate into a lower rate. People often never call their creditors to even ask for lower rates.

The best feature of this method. First call your creditors to negotiate lower interest rates This is the all-important first step that most people skip. If youre struggling to pay off credit card debt youre not alone.

Heres how to do it. If youre struggling to pay card debt. So paying off your credit card debt with an installment loan could significantly boost your credit especially if you dont already have any installment loans on your credit reports.

The best way to reduce credit card debt Step 1. Consolidate your debt Sometimes its best to reduce your credit card debt by consolidating your debt into a lower interest rate loan. When you use a personal loan to reduce the number of payments you need to make each month it can make managing your debts much easier.

Attack the smallest debt with a vengeance. For this option the credit card company may be willing to lower your interest rate waive or reduce the minimum monthly payment andor remove late fees in an agreed-upon plan. Another way is to take out a home equity loan and use the proceeds to pay down or pay off your card debt.

Assess your credit card damage. If youre struggling with card debt dont bury your head in the sand. Two of the most common ways to consolidate credit card debt are as follows.

The interest rate on the consolidation loan is significantly less than the rate on your credit cards. Take all the credit cards you have and set them on. Thats one of the best ways to avoid debt.

You are working towards reducing your credit card debt so you should be ready to make sacrifices. One way to convert credit card debt to home equity debt is to refinance your mortgage and use the cash to pay down or pay off your card balances. In fact the faster you pay off your debts the more your credit score will improve.

How to reduce the cost of your credit and store card debt. A popular budget strategy is the envelope method where you set aside the exact amount of cash you need each month placing hard limits on spending. Ideally you should come up with a budget and pay off your debts as soon as possible.

Here are a few strategies that can help you pay down that debt. A balance transfer credit card typically. Make the minimum payment on.

Your credit card company may temporarily reduce your interest rates for a hardship if you ask for it. For those with multiple credit cards and high interest rates debt consolidation may be right for you. Get a balance transfer card.

You can pay back your credit and store card debt faster and save a lot of money. Pay the most expensive card first. Equity is the value of your home minus the amount you owe on your existing mortgage.

This is a loan that consolidates all of your credit card debt into one bill and one lower-interest payment per month. Cook your food at home because it is cheaper and will help you save money. A personal loan can mitigate overload.

If you need help enroll in a. You will see that with time your debt will reduce significantly. Remember that the credit cards interest rate will return to normal when the term ends.

10 Best Tips For Reducing Credit Card Debt Lifeguideblog

10 Best Tips For Reducing Credit Card Debt Lifeguideblog

Ways To Lower Credit Card Debt Cleared For Success Lower Credit Card Debt Credit Cards Debt Improve Credit Score

Ways To Lower Credit Card Debt Cleared For Success Lower Credit Card Debt Credit Cards Debt Improve Credit Score

The Fastest Method To Eliminate Credit Card Debt

The Fastest Method To Eliminate Credit Card Debt

10 Ways To Reduce Your Credit Card Debt Kent A Cornell Cfp

10 Ways To Reduce Your Credit Card Debt Kent A Cornell Cfp

5 Ways To Reduce Your Credit Card Debt Debtblue

5 Ways To Reduce Your Credit Card Debt Debtblue

3 Ways How To Get A Lower Interest Rate On Credit Cards Cardrates Com

3 Ways How To Get A Lower Interest Rate On Credit Cards Cardrates Com

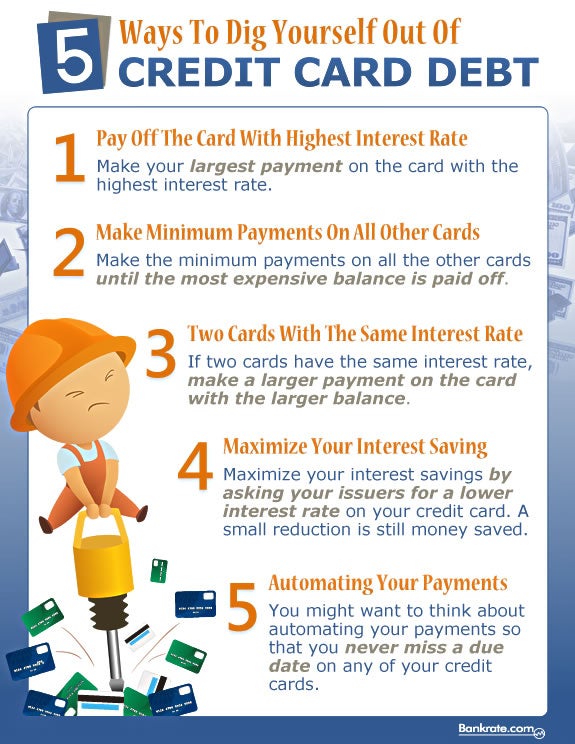

5 Ways To Reduce Credit Card Debt

How To Pay Off Credit Card Debt Fast Credible

How To Pay Off Credit Card Debt Fast Credible

6 Simple Ways To Lower Your Credit Card Debt An Easy To Follow Guide

6 Simple Ways To Lower Your Credit Card Debt An Easy To Follow Guide

:max_bytes(150000):strip_icc()/exhausted-businessman-running-away-from-credit-card-170886185-5770a3ff3df78cb62ce6521c.jpg) Ways To Avoid Credit Card Debt

Ways To Avoid Credit Card Debt

Help With Credit Card Debt Federal Trade Commission

Help With Credit Card Debt Federal Trade Commission

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png) How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

Ppt Ways To Reduce Credit Card Debt Powerpoint Presentation Free Download Id 6296420

Ppt Ways To Reduce Credit Card Debt Powerpoint Presentation Free Download Id 6296420

Comments

Post a Comment